February 2026 is a key period for millions of Americans because it sits in the middle of the federal tax filing season. During this time, many taxpayers are actively checking their refund status and watching their bank accounts for deposits. For a large number of households, a tax refund is not extra spending money. It is often used for essential needs such as rent, medical bills, loan payments, school costs, groceries, and utility expenses. Because of this, understanding how refund timing works and what determines the amount is extremely important.

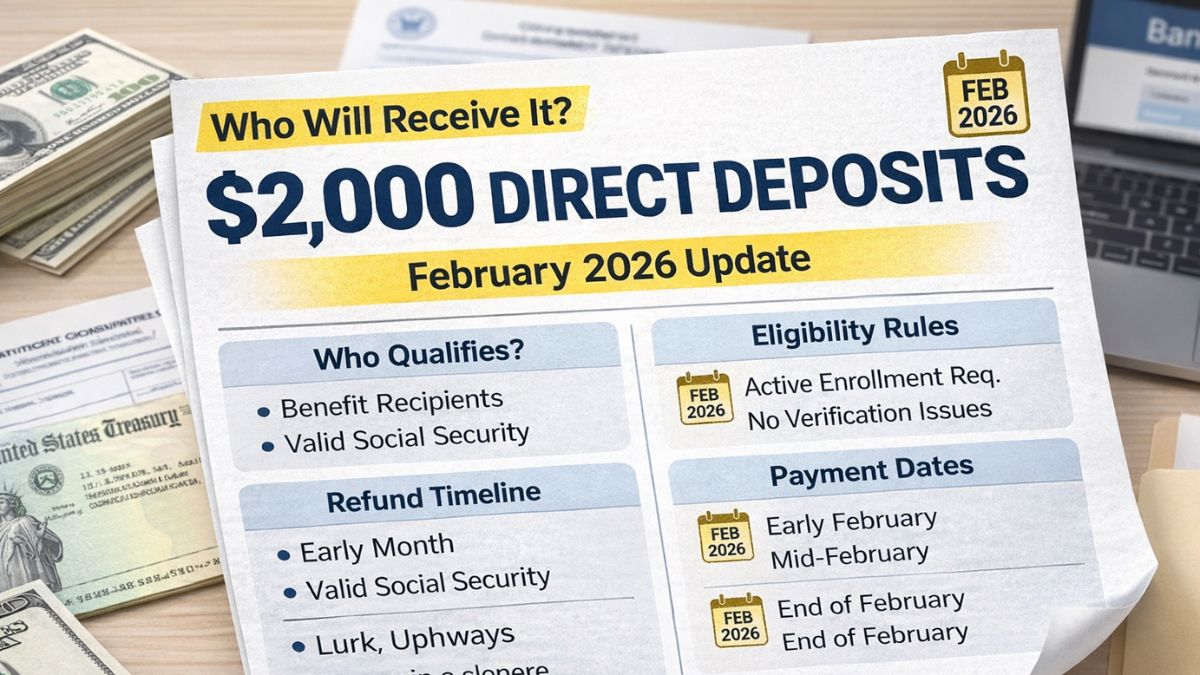

In recent weeks, there has been growing online discussion about $2,000 direct deposits arriving in February 2026. These claims can sound like a guaranteed federal payment, but the reality is more detailed. Most of these references are tied to estimated refund averages rather than a universal government payout. Tax refunds are based on personal tax returns, not a fixed national distribution.

Why Refund Dates Are Not the Same for All Taxpayers

One of the most common misunderstandings about tax refunds is the belief that everyone receives them at the same time. That is not how the system works. Refund timing is different for each taxpayer because every return is different. The date you file, the method you use to file, the credits you claim, and whether your return needs extra review all influence when your money is released.

Some taxpayers submit their returns as soon as filing opens, while others wait until later in the season. Early filing often leads to earlier processing, but even then, approval is not automatic. Each return must pass through verification steps before a refund is issued. This is why two people who file on the same day may still receive refunds on different dates.

How Tax Returns Are Processed and Approved

When a tax return is submitted, it goes through multiple review stages. Electronic submissions enter the processing system quickly and are checked by automated programs first. These systems compare the numbers reported by the taxpayer with wage and income records submitted by employers and financial institutions. They also review claimed deductions and tax credits.

If the information matches and no warning flags appear, the return can move forward smoothly. If something looks inconsistent, the return may be pulled for manual review. Manual reviews take more time because a human examiner must check the details. In 2026, identity verification and fraud prevention checks remain a strong focus, which can also add processing time for some filers.

The Impact of Tax Credits on Refund Timing

Refunds that include certain refundable tax credits often take longer to process. Credits designed to support families and lower-income workers are especially likely to receive additional review. These reviews are required by law and are meant to prevent improper payments and identity misuse.

Because of these rules, taxpayers claiming these credits may notice that their refunds are approved later than returns without those credits. This does not mean there is a problem. It simply means the return follows a stricter verification path before funds are released.

Filing Method Makes a Major Difference

The way a tax return is filed has a direct effect on how fast a refund arrives. Electronic filing remains the fastest and most reliable method. It reduces data entry errors, speeds up receipt confirmation, and allows status tracking shortly after submission. Most modern tax software also checks for common mistakes before filing, which lowers the risk of delays.

Paper filing is slower because it depends on physical handling and manual data entry. During busy tax season periods, paper returns can take several additional weeks to move through the system. Even when approved, paper-filed refunds may still take longer to reach the taxpayer.

Choosing Direct Deposit vs Paper Check

Refund delivery method is another key timing factor. Direct deposit is usually the quickest way to receive a refund once it is approved. Funds are sent electronically to a bank account, often arriving within days after authorization. This method also avoids postal delays and reduces the risk of lost checks.

Paper checks take longer because they must be printed and mailed. Delivery time depends on mail volume and local postal conditions. In peak season, this can noticeably extend the wait.

Understanding the $2,000 Refund Conversation

Every year, refund season brings headlines and social media posts mentioning $2,000 deposits. This number is often based on historical average refund amounts, not a guaranteed payment. Actual refunds vary widely from person to person. Income level, tax withheld, filing status, dependents, and credits claimed all shape the final number.

Some taxpayers will receive more than $2,000. Others will receive less. Some may not receive a refund at all if their withholding was low or if they owe additional tax. It is important not to treat the $2,000 figure as a promised government deposit.

What Can Help a Refund Arrive Sooner

Accuracy and early filing are two of the strongest factors that help refunds move faster. Returns that are complete, consistent, and error-free pass automated checks more easily. Double-checking income figures, spelling of names, Social Security numbers, and bank account details reduces the chance of processing holds.

Taxpayers with simple returns and no special credit claims are often processed more quickly. Those who file early and select direct deposit frequently receive refunds by mid-to-late February, provided no review issues appear.

Managing Expectations During Refund Season

It is helpful for taxpayers to view refund timing as a range rather than a fixed date. Processing systems handle millions of returns, and review steps are designed to protect both the government and the taxpayer. While waiting can be stressful, these safeguards reduce fraud and prevent incorrect payments.

Planning expenses without depending on a specific refund date is generally safer. Checking refund status through official tracking tools is more reliable than relying on rumors or viral posts.

Disclaimer

This article is for informational purposes only and does not provide tax, legal, or financial advice. Refund amounts and processing timelines depend on individual tax situations, filing accuracy, and review requirements. For official and up-to-date guidance, readers should consult the IRS website or speak with a qualified tax professional.